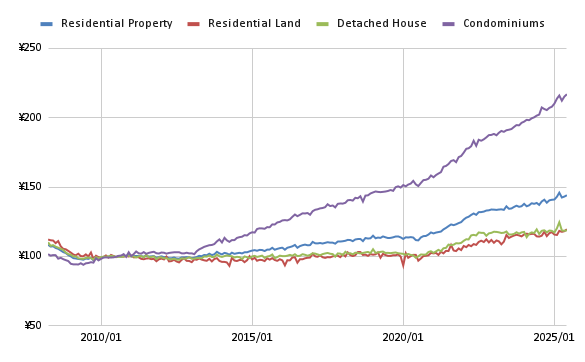

1. Overview of Price Trends

Japan’s real estate market has entered a sustained period of price increases, particularly in major metropolitan areas. According to recent data from [industry sources], values for residential properties in Tokyo, Osaka and other key cities have risen year-over-year for several consecutive quarters. Sentiment remains positive as many underlying conditions continue to support the up-trend.

2. Key Drivers

- Urban Demand and Limited Supply

High demand for quality housing in central locations has outpaced new construction, especially in well-connected districts of Tokyo and Osaka. The scarcity of land and resistant zoning/regulatory constraints have further limited fresh supply. - Low Interest Rates and Financing Conditions

With interest rates remaining historically low, borrowing costs have stayed affordable for many buyers. This environment has encouraged both individual home-purchases and investment into residential units. - Wealthy and International Buyers

Domestic high-net-worth individuals and foreign investors have increasingly targeted premium properties in Japan. A weaker yen has improved purchasing power for foreign capital, while global persistent low yields have driven funds to seek stable assets like Japanese real estate. - Inflation and Cost Pressures

Rising construction, labour and materials costs have pushed up the replacement cost of buildings, which in turn supports asset valuations. This “cost floor” effect has helped anchor prices even when transaction volumes momentarily soften. - Policy and Structural Factors

Government initiatives intended to support regional revitalisation, infrastructure investment and foreign-resident attraction have added momentum to local markets. In addition, demographic shifts such as ageing populations and urban migration contribute selective pockets of strength.

3. Caveats and Outlook

Despite the current strength, risks remain. A potential rise in interest rates, regulatory tightening or sudden supply increases could moderate growth. Nevertheless, many analysts anticipate that prices will remain elevated through the near term, with significant price corrections appearing unlikely unless multiple adverse factors converge.

4. Conclusion

Japan’s real estate market is being underpinned by a confluence of demand, financing and structural supply constraints. The sustained upward trend in property values reflects deeper economic and policy dynamics, not a speculative bubble alone. While vigilance is warranted, the market’s current trajectory appears robust.